As a family physician, you provide care for countless numbers of patients in your clinic. After paying for multiple expenses required to keep the business going, there is excess cash in your bank account that can be used somewhere productive.

This is where this guide can help. Here, we’ll break down how to manage the cash in your treasury, so your clinic’s finances are prepared for the future.

What is Treasury Management?

Treasury management has multiple aspects that fall under the umbrella term. It encompasses the management of a company’s daily cash flows and larger-scale investment decisions. These processes ensure the cash in your business bank account is utilized effectively.

Options

Traditional treasury management is to put excess cash into high yield savings accounts. But in times of low interest rates, there are few options for that capital to stay productive.

In times of high inflation, treasury management becomes even more important. As a business owner, your job is to make sure that your treasury keeps up with inflation.

In the environment now, you’re being offered 1-2% interest to have your money in a bank’s savings account. If you are earning 1% on your treasury but inflation is 5%, then you are more or less losing 4% of your purchasing power every year.

Solutions

One solution is to place it in higher yield investments. Ledn offers a savings account that can be an option.

Ledn offers an 8.00% APY return on USDC with no minimum balance and no locked-in term. This means that you can park your excess capital into USDC (backed 1:1 with USD in a bank account) and be able to withdraw it whenever you want. In the meantime, you are earning 8% APY.

How To Fund

You can fund using Bitcoin or USDC. The easiest way to fund your Ledn account is to fund using PayTrie. This is the most direct way to fund your Ledn account using Interac e-Transfer.

To receive USDC in your Ledn account, you would first need to set up an account at www.paytrie.com

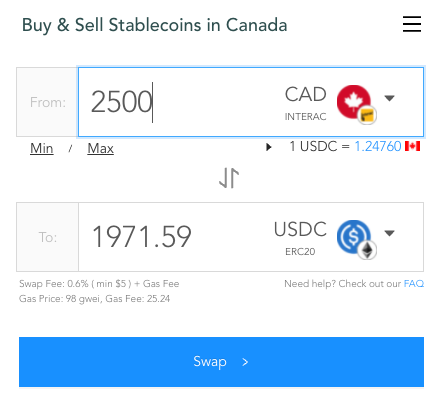

After completing the sign-up process, you can choose the amount that you would like to send to Ledn. In this example, if you would like to send $2500 CAD, you would end up with 1971.59 USDC. This rate will fluctuate according to the exchange rate of CAD to USD and also according to the gas prices. You can time your purchases to when gas prices are lower to save some money.

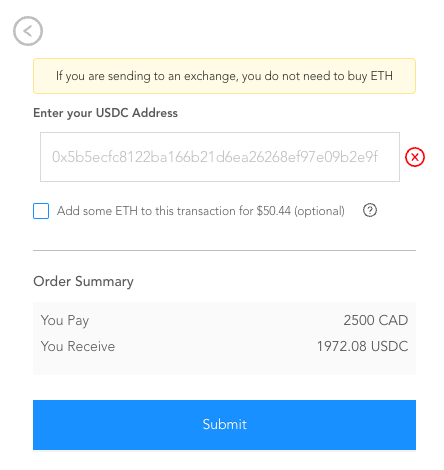

After clicking Swap, you’ll be prompted to enter your Ledn wallet address. Be sure you double check the wallet address so that it matches with the wallet address that Ledn provides. The option to “Add some ETH to this transaction” is not required, so you can leave this box unchecked.

Next, PayTrie will send a Request Money Transfer to your email requesting the amount you’ve booked (in this case $2500). You have to log in your bank account and choose “accept”. Once the eTransfer arrives at PayTrie, the USDC will be sent directly to Ledn. They say to allow 24 hours for the first transaction, but my first transaction took a little longer than an hour. Transactions after that have taken less than an hour.

Once the USDC is in your Ledn account, you can choose whether to start earning interest, or trade for Bitcoin and start earning interest/borrow off the Bitcoin.