The word had spread about your business. Past clients were beyond satisfied with your work and referred you to their friends, increasing your reputation and client list along with your income. Now you’ve set aside some money and would like to put it into some sort of investment account.

This guide into treasury management will hopefully spark your interest and be helpful to the long-term health of your electrician business.

What is Treasury Management?

Treasury management encompasses the management of a company’s daily cash flows and larger-scale investment decisions. Doing so will help your business prepare for any unexpected risks that may arise. At the end of the day, we want to know that the cash sitting in your corporate bank account is being utilized correctly.

Options

Traditional treasury management is to put excess cash into high yield savings accounts. However, during times of low interest rates, there are limited options for that capital to stay productive.

Treasury management becomes even more important during times of high inflation. As a business owner, your job is to make sure that your treasury keeps up with inflation.

With current conditions, banks are offering 1-2% interest to park your money in their savings account. If you are earning 1% on your treasury but inflation is 5%, then you are basically losing 4% of your purchasing power every year.

Solutions

One solution is to park it in higher yield investments. A savings account with Ledn can be one of your choices.

Ledn offers an 8.00% APY return on USDC with no minimum balance and no locked-in term. This means that you can park your excess capital into USDC (backed 1:1 with USD in a bank account) and be able to withdraw it whenever you want. In the meantime, you are earning 8% APY.

How To Fund

You can use Bitcoin or USDC to fund. The easiest way to fund your Ledn account is by using PayTrie, which will directly fund your Ledn account using Interac e-Transfer.

To fund your account with USDC, you need to set up an account at www.paytrie.com

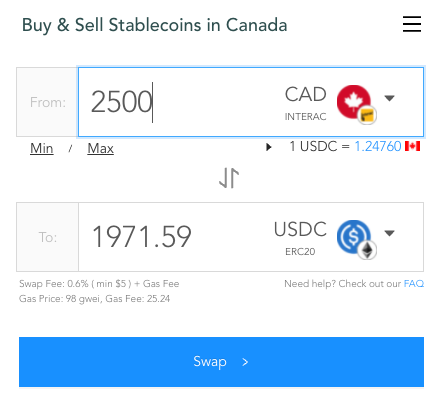

After setting up your account, you can choose the amount that you would like to send to Ledn. For example, if you would like to send $2500 CAD, you would end up with 1971.59 USDC. This rate will change according to the exchange rate of CAD to USD and also according to the gas prices. Timing your purchase and buying when gas prices are lower can also help save some money.

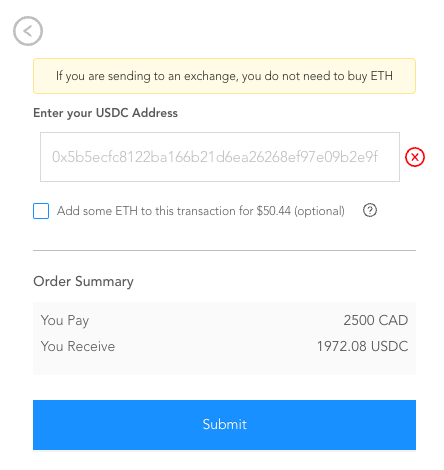

Once you’ve clicked Swap, you will need to enter your Ledn wallet address. Remember to double check the wallet address to confirm it matches the wallet address that Ledn provides. You can also choose to leave the “Add some ETH to this transaction” box unchecked.

Next, PayTrie will send a Request Money Transfer to your email requesting the amount you’ve booked (in this case $2500). You’ll need to log in your bank account and click “accept”. Once the eTransfer arrives at PayTrie, the USDC will be sent directly to Ledn. The first transaction can take up to 24 hours, but my first transaction took a little longer than an hour. Subsequent transactions have taken less than an hour.

Once the USDC is in your Ledn account, you can decide if you want to start earning interest, or trade for Bitcoin and start earning interest/borrow off the Bitcoin.