There’s no shortage of contractors needed, so you spend your days going from one project to another. These are long days, but it also means a healthy bank account. What options are there to put this cash towards something that will help you in the long run?

We’re diving into treasury management in this guide, which is something pretty significant to consider when thinking of the long-term health of your business.

What is Treasury Management?

Treasury management is more than just cash flow. In the short-term, this involves managing your company’s daily cash flows. In the long-term, larger-scale investment decisions also come into play. At the end of the day, we want to know that the cash sitting in your corporate bank account is being optimized appropriately.

Options

Traditional treasury management is to put excess cash into high yield savings accounts. However, during times of low interest rates, there are limited options for that capital to stay productive.

During periods of high inflation, treasury management becomes ever more important. As a business owner, your job is to make sure that your treasury keeps up with inflation.

In the current environment, banks are offering 1-2% interest to park your money in their savings account. If you are earning 1% on your treasury but inflation is 5%, then you are in effect losing 4% of your purchasing power every year.

Solutions

One solution is to park it in higher yield investments. One way to do this is through a savings account with Ledn.

Ledn offers an 8.00% APY return on USDC with no minimum balance and no locked-in term. This means that you can park your excess capital into USDC (backed 1:1 with USD in a bank account) and be able to withdraw it whenever you want. In the meantime, you are earning 8% APY.

How To Fund

Funding can be done with either Bitcoin or USDC. The easiest way to fund your Ledn account is to fund using PayTrie. This is the most direct way to fund your Ledn account using Interac e-Transfer.

Before funding your Ledn account, you would need to set up an account at www.paytrie.com

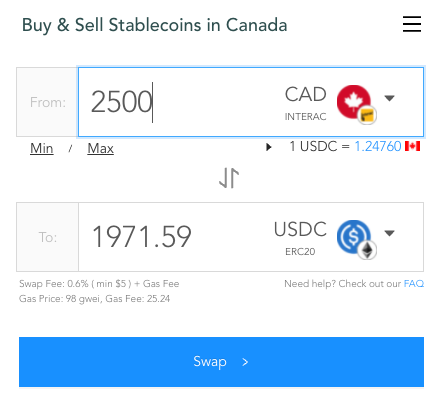

Once you’ve gone through the set-up process, you can choose the amount that you would like to send to Ledn. For example, if you would like to send $2500 CAD, you would end up with 1971.59 USDC. This rate will change according to the exchange rate of CAD to USD and also according to the gas prices. You can save some money by timing your purchase when gas prices are lower.

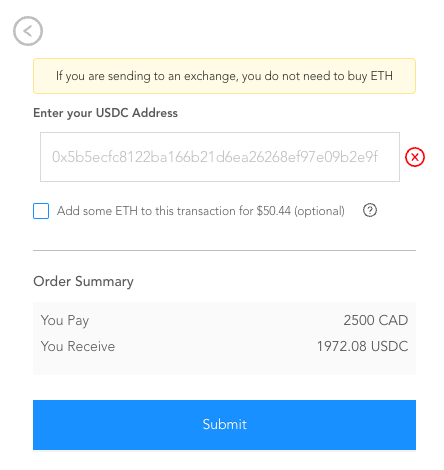

Once you’ve clicked Swap, you will need to enter your Ledn wallet address. Make sure you double check the wallet address to make sure it matches with the wallet address that Ledn provides. You can also choose to leave the “Add some ETH to this transaction” box unchecked.

Next, PayTrie will send a Request Money Transfer to your email requesting the amount you’ve booked (in this case $2500). You’ll just need to log in your bank account and click “accept”. Once the eTransfer arrives at PayTrie, the USDC will be sent directly to Ledn. They say that the first transaction can take up to 24 hours, my first transaction took a little longer than an hour. Subsequent transactions have taken less than an hour.

Once the USDC is in your Ledn account, the decision is yours to decide on starting to earn interest, or trade for Bitcoin and start earning interest/borrow off the Bitcoin.